Biweekly tax withholding calculator

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

Calculating Federal Income Tax Withholding Youtube

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators.

. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. 250 and subtract the refund adjust amount from that. If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck.

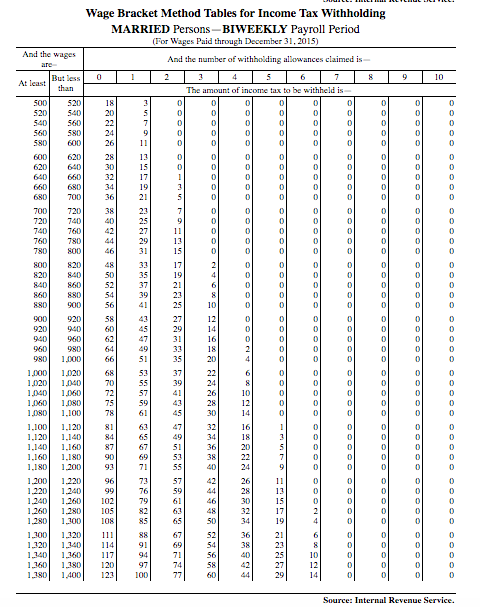

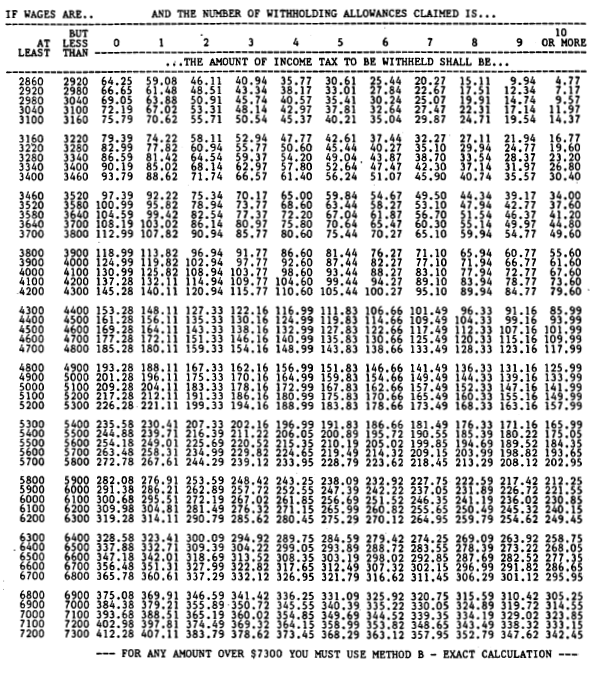

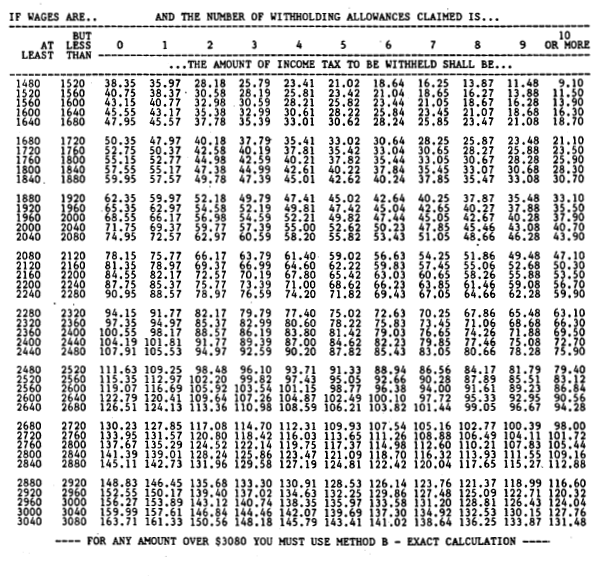

For 2010 the value of each biweekly allowance equals 14038 so if you claimed three allowances you would multiply 14038 by 3 to get 42114. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding. This publication supplements Pub.

15 Employers Tax Guide and Pub. Use the tax withholding. Online Withholding Calculator For Tax Year 2022.

If you are thinking about becoming a resident of the Hoosier State our Indiana mortgage guide can help answer a lot of the questions you may have about getting a mortgage in Indiana with. Number of Exemptions from MW507 Form. Although income taxes on wages are.

If you are withholding. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. The calculator can help estimate Federal State Medicare and Social Security tax.

Then look at your last paychecks tax withholding amount eg. That means that your net pay will be 40568 per year or 3381 per month. 51 Agricultural Employers Tax Guide.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The withholding calculator can help you figure the right amount of withholdings. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

See the IRSs Withholding Estimator. Ask your employer if they use an. Thats where our paycheck calculator comes in.

To change your tax withholding amount. All Services Backed by Tax Guarantee. That result is the tax withholding amount.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. For employees withholding is the amount of federal income tax withheld from your paycheck. Employers can use the calculator rather than manually.

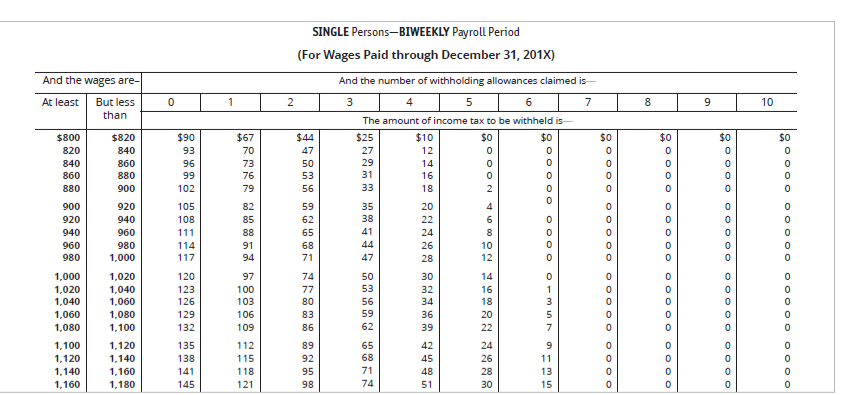

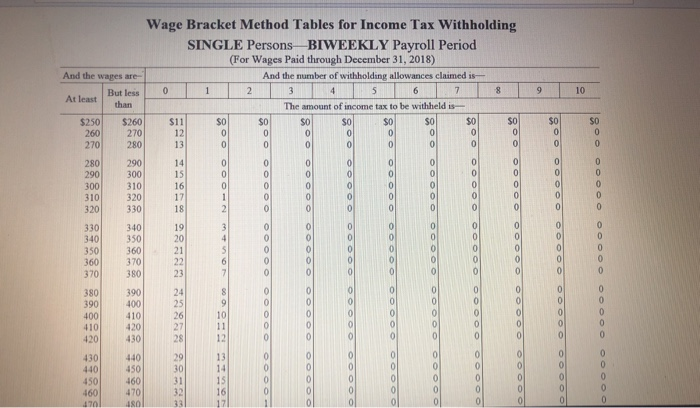

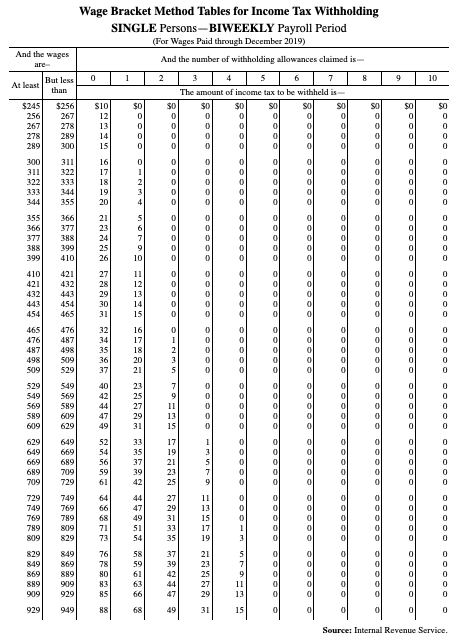

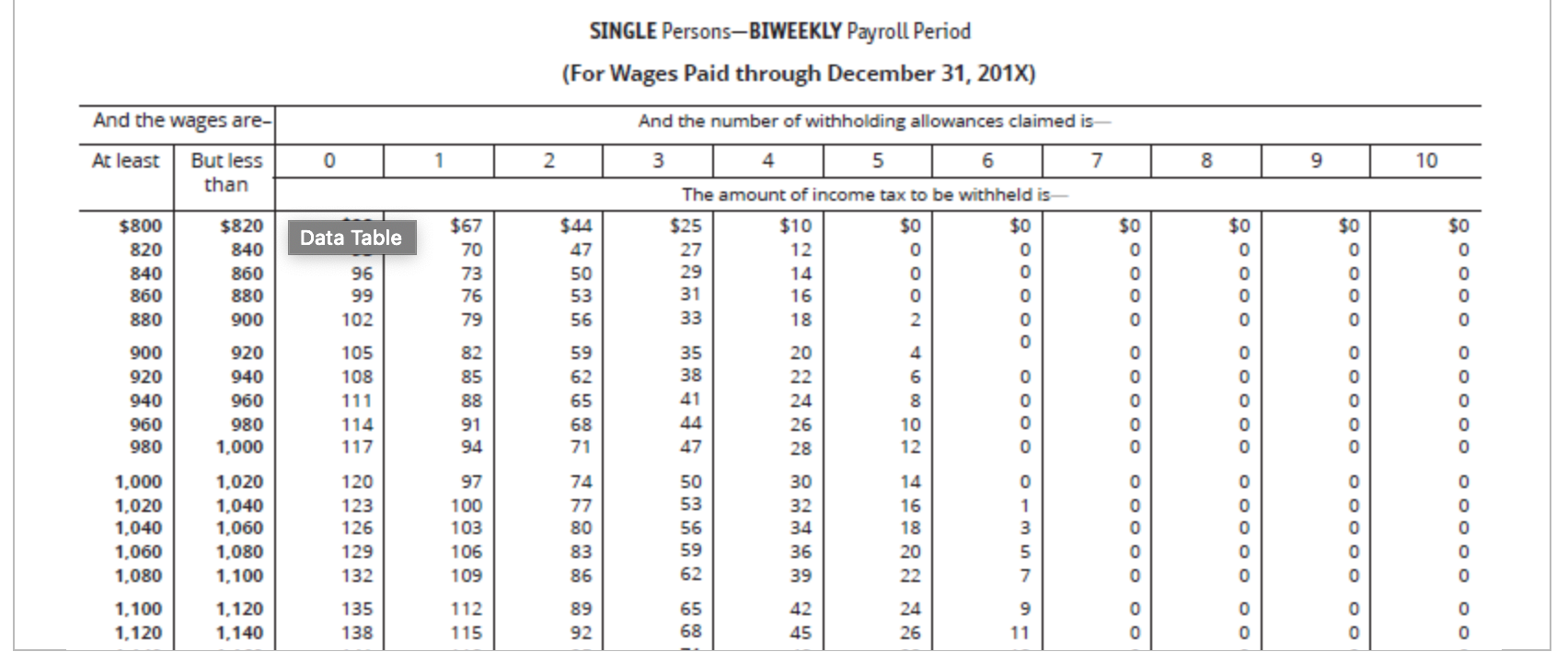

Biweekly pay 48 weeks. If you participate in tax. Based on the number of withholding allowances claimed on your W-4 Form and the amount of wages calculate the amount of taxes to withhold.

It describes how to figure withholding using the Wage. To help determine the number of allowances to claim on your W-4 form. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. 250 minus 200 50. Computes federal and state tax.

Your average tax rate.

Solved Compute The Net Pay For Each Employee Using The Chegg Com

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Solved Calculate The Amount To Withhold From The Following Chegg Com

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Solved Note Use The Tax Tables To Calculate The Answers To Chegg Com

1 On December 5 201x Prepare A Payroll Register Chegg Com

Solved Wage Bracket Method Tables For Income Tax Withholding Chegg Com

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes For Employees Startuplift

How To Calculate Federal Income Tax

395 11 Federal State Withholding Taxes

How To Calculate Federal Income Tax

395 11 Federal State Withholding Taxes

2022 Income Tax Withholding Tables Changes Examples